© 2023 Global News, a division of Corus Entertainment Inc.

Union workers for the St. Lawrence Seaway Management Corporation walked off the job on Sunday, demanding higher wages, causing significant disruptions throughout Canada. The strike, which has paralyzed access to the St. Lawrence Seaway across Ontario and Quebec, is raising concerns among Saskatchewan producers who heavily rely on the seaway for exporting their goods and commodities.

A total of 360 Unifor members initiated the strike, effectively shutting down access to the seaway and causing a ripple effect across the Saskatchewan economy. As a landlocked province, Saskatchewan relies on the St. Lawrence Seaway and the Vancouver port to export goods and commodities.

Wade Sobkowich, the Western Grain Elevator Association (WGEA) executive director, expressed the urgency of the situation.

“Time is ticking. Thunder Bay freezes at the end of December, shutting down access to the seaway,” Sobkowich said. “The harvest on the Prairies comes in September and October, so the portion that needs to move over the Atlantic Ocean only has about three months to do it. To have a stoppage for any length of time is time you don’t get back.”

Story continues below advertisement

He emphasized that grain exporters must ensure that products reach buyers in time to avoid marooning in Thunder Bay due to freeze-up.

Contract extension penalties or defaulting on contracts are looming threats, Sobkowich said.

“Reputation damage to Canada and Saskatchewan will occur if we cannot deliver our product within the window we agreed to,” he said.

The impacts of the strike are far-reaching, affecting every part of the supply chain and potentially forcing grain sales at lower rates outside peak price periods.

The concerns expressed by Canpotex, a major player in the industry, further underscore the severity of the situation.

“We’re concerned about the current disruption in the St. Lawrence Seaway, especially after the prolonged strike at the Port of Vancouver in July,” Canpotex stated.

“We rely heavily on the Port of Thunder Bay as we continue to make up volumes impacted by the Port of Vancouver strike. This labor disruption will delay potash shipments needed for crops’ growing seasons, potentially impacting food production in our overseas markets and risks Canada’s reputation as a reliable, stable trading partner.”

Stewart Wells, a wheat farmer in southwestern Saskatchewan, said “it gums up the system if one of the players stops the chain.”

Story continues below advertisement

The strike poses significant challenges for farmers who depend on grain sales to meet their financial obligations. The uncertainty surrounding extra costs incurred by grain exporters could be charged to the farmers. Wells pointed out that current crop insurance programs and cash advance programs are providing some relief.

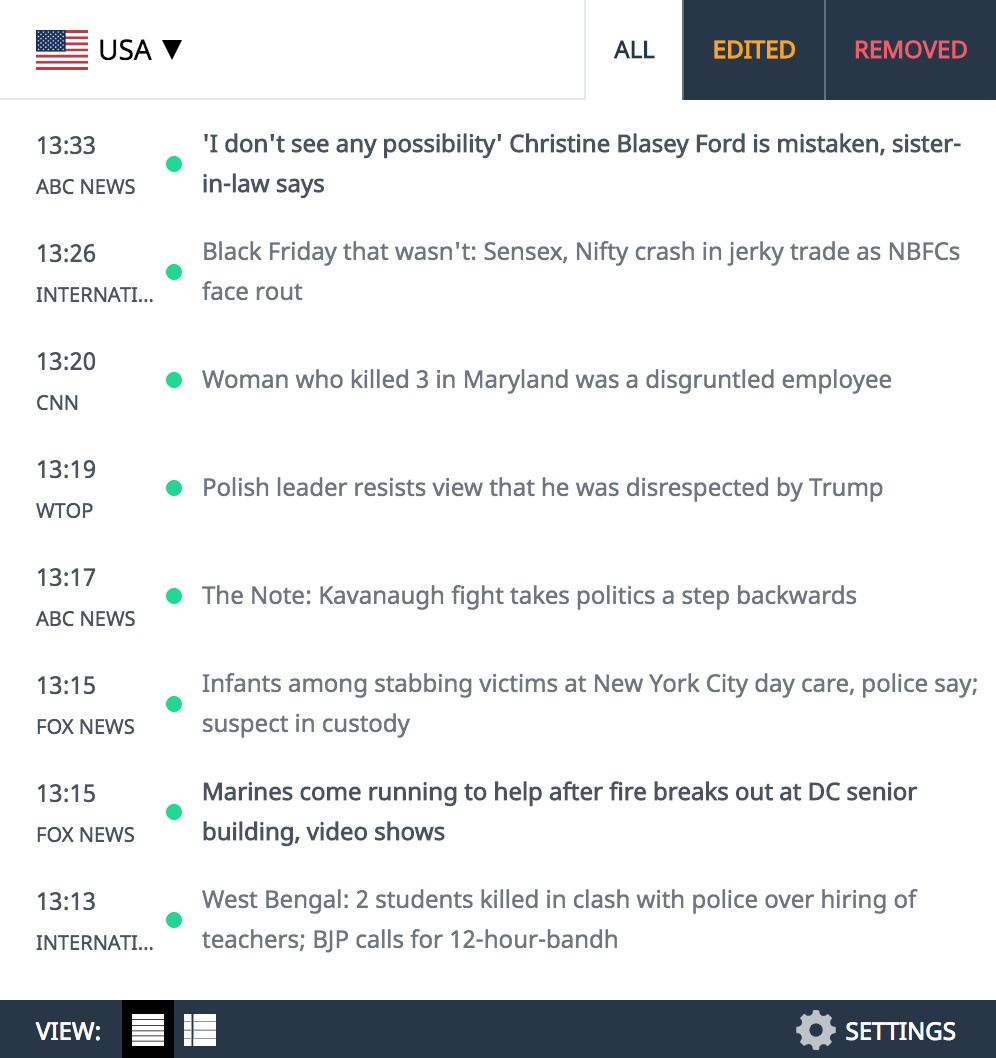

Trending Now

While expressing sympathy for the striking workers, Wells emphasized that “no one wins during a strike.”

“We have not seen any major consequences yet, but after two weeks, buyers might start to look elsewhere,” he said.

A pivot to the Vancouver port is not a viable option due to capacity limitations.

Margot Orr with the Greater Saskatoon Chamber of Commerce highlighted the province’s vulnerability to supply chain disruptions, citing previous challenges, including the 13-day port strike in Vancouver and the COVID-19 pandemic.

“Saskatchewan is an export province, and over the last three years, we have had significant supply chain disruptions,” Orr said.

Orr emphasized that any disruptions, whether short or long-term, have far-reaching consequences. Agriculture and potash industries in Saskatchewan are particularly impacted. During the Vancouver port strike, the province suffered economic repercussions of about $800 million every day, and while the St. Lawrence Seaway handles smaller volumes, the costs will still be significant.

Around 10 per cent of Canpotex’s potash is transported through the seaway.

Story continues below advertisement

“Everyone is going to be affected. Prices will go up for the consumer, farmers might run into cash flow problems from not selling their products, exporters might default on contracts, and buyers might start looking elsewhere for their products,” Orr said.