KUALA LUMPUR: The ringgit continued its downtrend against the greenback today amid concerns over the higher-for-longer US interest rate outlook, said an analyst.

SPI Asset Management managing partner Stephen Innes said high US bond yields and growing concerns over inflation in the US continued to weigh on the ringgit.

“Inflation concerns likely remain front and centre with higher oil prices complicating the policy outlook for the US Federal Reserve (Fed),” he told Bernama.

Ten-year US Treasury yields hit a fresh 15-year high yesterday but made a pullback today, going down five basis points to 4.501%.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the ringgit also weakened against the greenback due to fears over a US government shutdown.

“The fear of a US government shutdown seems to take centre stage as we head for the weekend deadline.

“A risk-off (sentiment is) certainly dominating the ringgit now,” he said, adding that the resistance level currently stood at RM4.74.

The US Congress is supposed to agree on a spending bill by the end of September, which otherwise could result in a government shutdown, he explained.

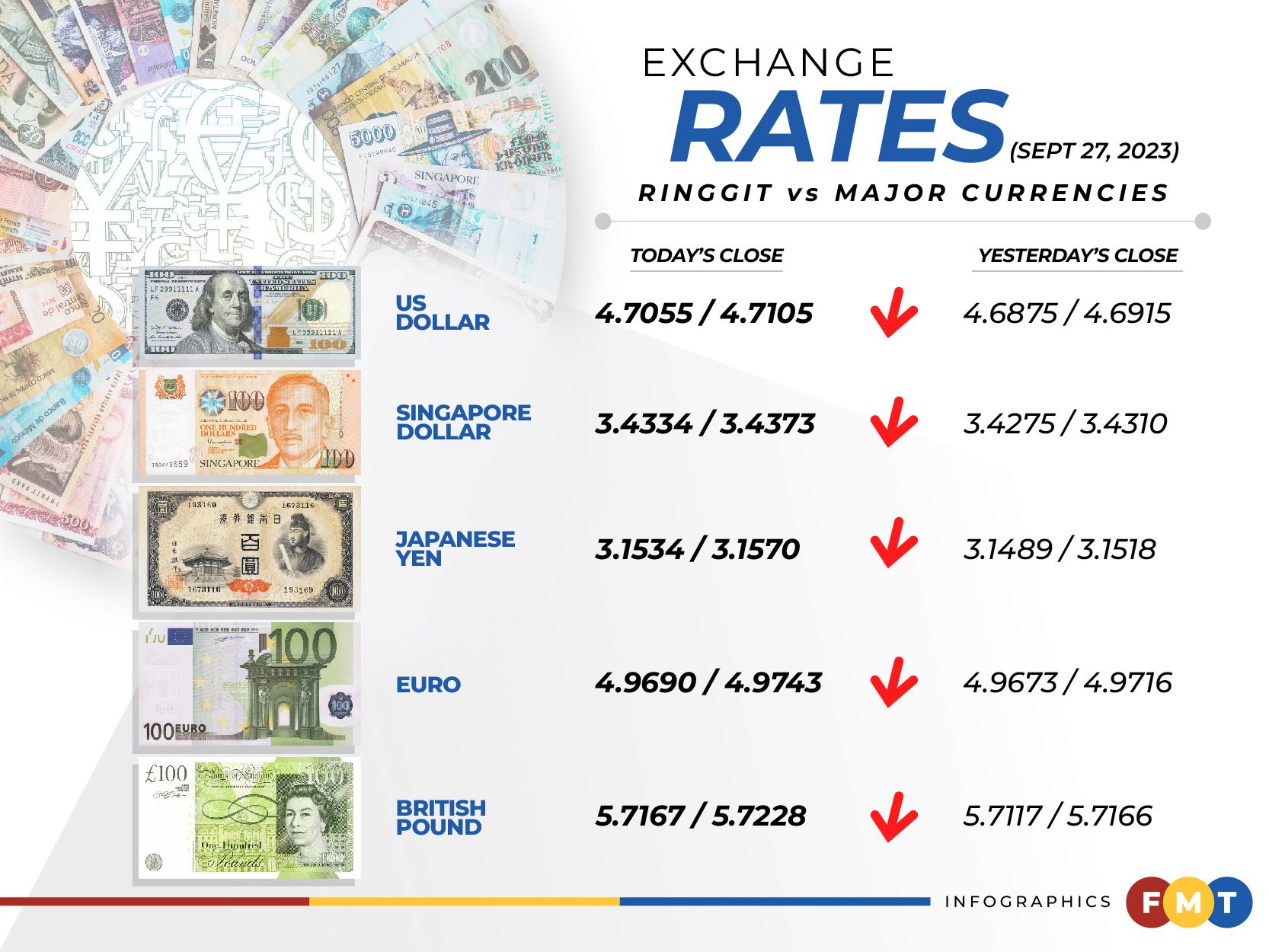

At 6pm, the local note fell to 4.7055/4.7105 against the US dollar from yesterday’s close of 4.6875/4.6915.

Meanwhile, the ringgit was traded lower against a basket of major currencies.

It eased against the euro at 4.9690/4.9743 from Tuesday’s closing of 4.9673/4.9716, depreciated against the British pound at 5.7167/5.7228 from 5.7117/5.7166 and declined against the Japanese yen to 3.1534/3.1570 from 3.1489/3.1518 yesterday.

At the same time, the local note was also traded lower against most Asian currencies. However, it appreciated against the Thai baht to 12.8759/12.8949 from 12.8884/12.9043.

It went down against the Indonesian rupiah to 303.1/303.6 from 302.5/303.0 previously, slid against the Philippine peso at 8.26/8.28 from 8.23/8.24 on Tuesday, and decreased against the Singapore dollar to 3.4334/3.4373 from 3.4275/3.4310 previously.